BETTER WAYS TO ADDRESS

RISK AND REDUCE FEAR

In view of the recent tough talk between the U.S. and North Korea about military might, we thought right now presents a good time to comment further on risk and fear.

We cherish long-lasting collaborative relationships with our clients. As we continually listen, search, and learn, we uncover methods and tools to better understand and measure risk and thereby reduce fear in our clients’ unique lives.

And yes, we have the ability to run diagnostics that include precise risk scenarios involving stocks, bonds, interest-rates, inflation, and even war.

But we do not rely on diagnostic systems that measure impacts on hypothetical market portfolios. Our diagnostics measure impacts on actual, specific portfolios. Our role as stewards inspires us to do more for our clients and their hard-earned wealth than rely only on passive adages like “it’s time in the market that counts.” It is interesting to note that we have recently tested prospective portfolios against unusual volatility to show, for example, that unknown risks exist in a portfolio composed purely of market tracking mutual funds.

With the aim of reducing fear through discipline, Glenwood Financial Partners works to:

- Monitor and offset volatility through decisive steps toward improving future Reward-to-Risk scenarios with Wealth Preservation as #1 Priority and commit to daily review of client holdings, asset allocation, cash flow, and unique objectives/risk tolerance scores

- Address and encourage all client questions and discussions in order to educate and close gaps in understanding by providing unlimited access to our team via in-person meetings and telephone calls

- Use plain language to communicate strategies, investment selection, and risks

- Augment the human talent within Glenwood and its key strategic partners with the use of best-in-breed technologies in financial planning, risk assessment, performance attribution, and investment analytics

In 2017, we have taken decisive action on clients’ behalf where suitable & necessary.

For example:

- Removal of one or more mutual funds from portfolios where extra fees, taxes, and risk factors go unrewarded

- Examined the hidden risks and levers that novice and pros sometimes take for granted — We scrub and attempt to remove these unwanted elements.

- Improved diversification with accurate measures of concentration across stocks, bonds, mutual funds, and exchange-traded funds

- Added investments that not only stand on their own merit but also complement the overall portfolio’s holdings, liquidity, resiliency, and transparency

- Exercised strict discipline. It’s important to define the price you are willing to pay or accept for any given stock, bond, piece of real estate, etc. Investors often get into trouble when they bend good rules, try to outguess markets, or introduce emotion into decision-making!

GLOBAL CONFLICTS: N.K.

After 10 straight days of the Dow closing up — including nine straight all-time highs — a cold chill, however brief, moved through our populace recently as President Trump retorted to new threats of attack from North Korea with his reference to “fire and fury like the world has never seen.” Markets reacted mildly lower, but ended the string of all-time highs.

This U.S.-North Korea episode reminds us once again that no market bull run is without volatility and risk. Events capable of unsettling the steady growth we’ve seen for quite some time may instantly occur at any moment.

North Korea’s saber-rattling of the past has been a sideshow for global markets that until recently has had no material effect. This week we saw a move towards safe haven assets that we believe is mostly coincidental to the geopolitical jawboning. Through the prism of market analysis, the modest pullback may favor a view of general profit taking rather than a major statement on risk avoidance.

In any event, we take seriously the threat that the North Korean regime is intent on developing deliverable nuclear weapons. While many observers resort to calling Pyongyang deranged, we pray our leaders will strategically move beyond name-calling to understand what really motivates North Korea, and what options the United States has to eliminate the North’s nuclear threat.

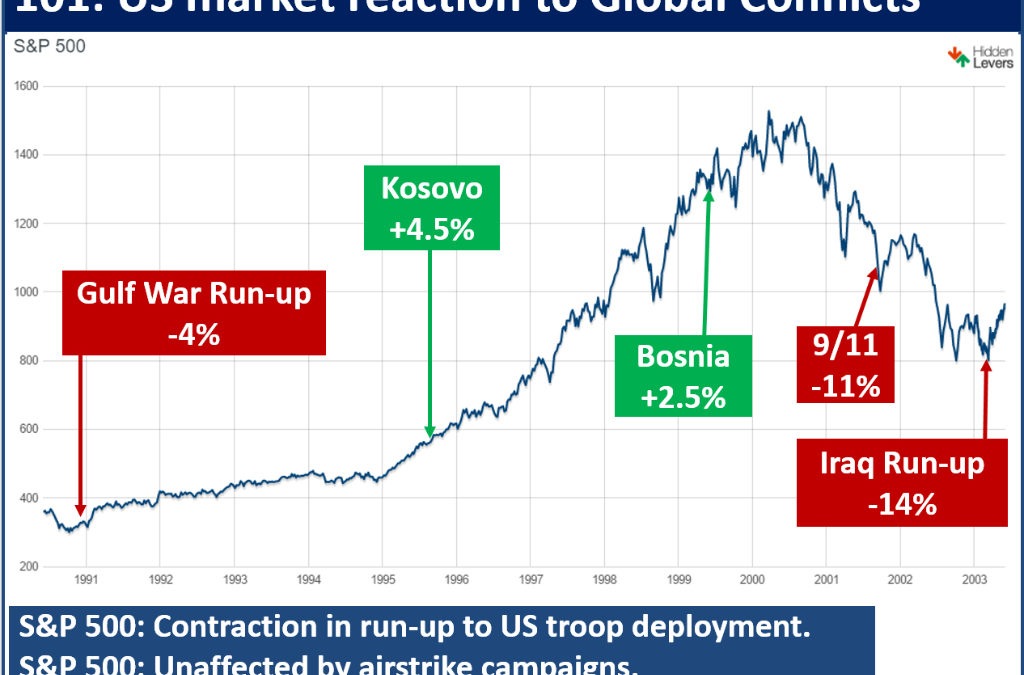

While no one can say that there is a serious threat of military action involving North Korea, this recent brush with risk and fear inspires us to look back at the performance of our capital markets during prior times of war. The results may surprise you.

The chart below supports our belief that we cannot out-guess markets, as the positive markets during actual wars indicate. We also sincerely believe that NO journey through conflict will be smooth for emotions or investment portfolios.

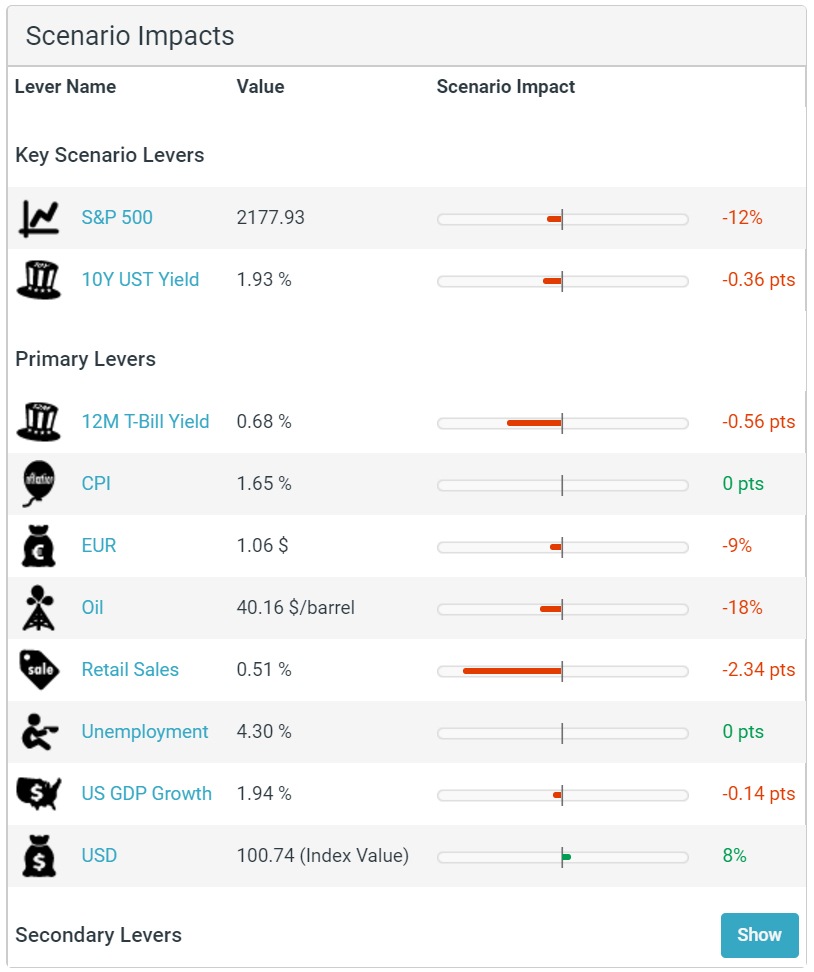

Volatility and uncertainty are unavoidable factors in capital markets. To counteract the fear of these factors, we will work with each investor to develop a personal discipline to carry them through the highs and the lows, and even through the tough talk of political leaders. For further insight into our multi-step diagnostic process, the below chart illustrates custom scenario inputs developed for a client’s retirement concerns.

Volatility and uncertainty are unavoidable factors in capital markets. To counteract the fear of these factors, we will work with each investor to develop a personal discipline to carry them through the highs and the lows, and even through the tough talk of political leaders. For further insight into our multi-step diagnostic process, the below chart illustrates custom scenario inputs developed for a client’s retirement concerns.

A hypothetical military action with North Korea would impact certain economic measures, including the S&P 500 performance, U.S. Treasury Yields, the price of Oil and Retail Sales. Based on these projections, we stress test the potential impacts these levers may have on the client’s actual holdings, risk tolerances, unique objectives, circumstances, and concerns.

A hypothetical military action with North Korea would impact certain economic measures, including the S&P 500 performance, U.S. Treasury Yields, the price of Oil and Retail Sales. Based on these projections, we stress test the potential impacts these levers may have on the client’s actual holdings, risk tolerances, unique objectives, circumstances, and concerns.

This chart is solely for illustration of the diagnostic tools available to help navigate risk and is not based upon any belief in actual military action involving North Korea or any other nation.

Today and tomorrow, our goal is to help you live your best life. Please consider us welcoming resources for any question or discussion in plain language. We believe in a forthright and caring approach, and we are always delighted to talk things over. We want to think better, do better, and serve better.

Email us or call at (919) 268-4101. Enjoy today!

The information set forth herein is for informational purposes only and should not be used as the sole basis for an investment decision. While we have made every attempt to ensure that the information contained in this Site has been obtained from reliable sources, we are not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this Site is provided “as is,” with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied.