SERIOUSLY—Rewards will come to those able to patiently withstand volatility and uncertainty. Leading up to 2020, client portfolios were already benefiting from a basket of disruptive ideas and themes built-in to complement core holdings like corporate and municipal bonds, global leaders, and mid-sized growth companies. Of course, risk management is always a priority, so in many cases, tactical cash and hedged equity positions were added as well.

Today, the COVID-19 crisis has accelerated our knowledge-focus even further and resolved us to advocate for increased investments in disruptive innovations. Sitting on our hands is not an option when it comes to bridging to the other side of risks like global recession, plummeting oil prices, and empty office buildings. America will reopen for business—America will not be the same as we left her in 2019.

Glenwood’s long-standing view that the future is coming faster and brighter than we think, has kept our hands steady in the face of 2020’s challenges. Delivered at hyper speed, historic disruption will demand a response from us all.

A Windshield View

History has proven time and again that tumultuous times bring about vast changes and give birth to new ideas. Sure, COVID-19 has boosted entertainment options like Netflix and communication forums like Zoom. However, as Glenwood outlined in last September 2019’s commentary, “Will You Profit from the Revenue Explosions of Esports?”, there are exponentially growing areas beyond TV shows, movies, and Brady Bunch style videoconferencing.

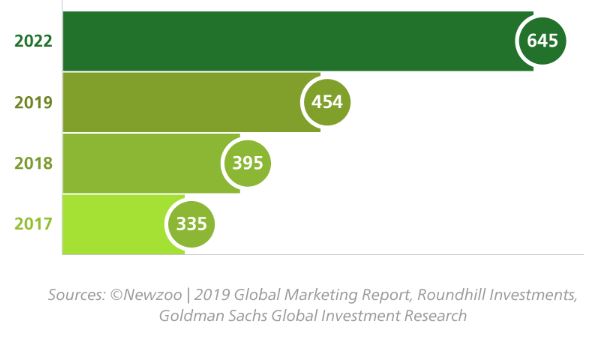

E-sports is a form of sport competition using organized, multiplayer video games, particularly between professional players, individually or as teams. In competitive tournaments, the data indicates that more than $700 million in prize money has been paid out to professional gamers, who can earn up to $15,000 an hour broadcasting games on live-streaming platforms.

E-Sports Audience in Millions

Esports is huge for the gamers, but it gets crazier! Last Thursday night witnessed the debut of a one-of-a-kind musical journey featuring rapper Travis Scott. Entitled Astronomical, it was the world premiere of a brand-new track via Fortnite’s online streaming game— Including those who watched via live streaming services like Twitch (owned by Amazon), more than 15 million people viewed Astronomical.

Owned by Cary, North Carolina’s own Epic Games, Fortnite is hosting crossover events and becoming more than just a game. Players are hanging out in its digital world and enjoying concerts, TV shows, and even exclusive movie trailers. While this may all seem a little foreign to those of us with gray hair (video games, really?), the numbers and dollars are exponentially growing billion by billion. The stay-at-home phenomena benefits a globally diverse group of companies in hardware, software, graphics chips, advertising, streaming, merchandising, …

People, Tech and Tools!

Human ingenuity is rapidly advancing 3D-printing, robotics, drones, lab-on-a-chip, and other sci-fi sounding innovations. For example, drug R&D efficiency was already booming from the convergence of three technologies – DNA sequencing, artificial intelligence (AI), and gene editing; however, COVID-19 is forcing greater speed, adoption, and realization of cost reductions. The convergence of those three powerful innovations is reducing time-to-market and lowering the failure rate of drug candidates. Our research partners are modeling improvements of 10% and 25%, respectively, in the drug failure rate and time-to-market. So, innovative drug companies could be on the cusp of delivering upside earnings surprises and creating tremendous value to patients, society, and the Healthcare industry. Collectively viewed, Healthcare is the second largest equity sector-weight for Glenwood’s clients, and we are not talking about old companies with no growth.

GROWING IN DOG YEARS!

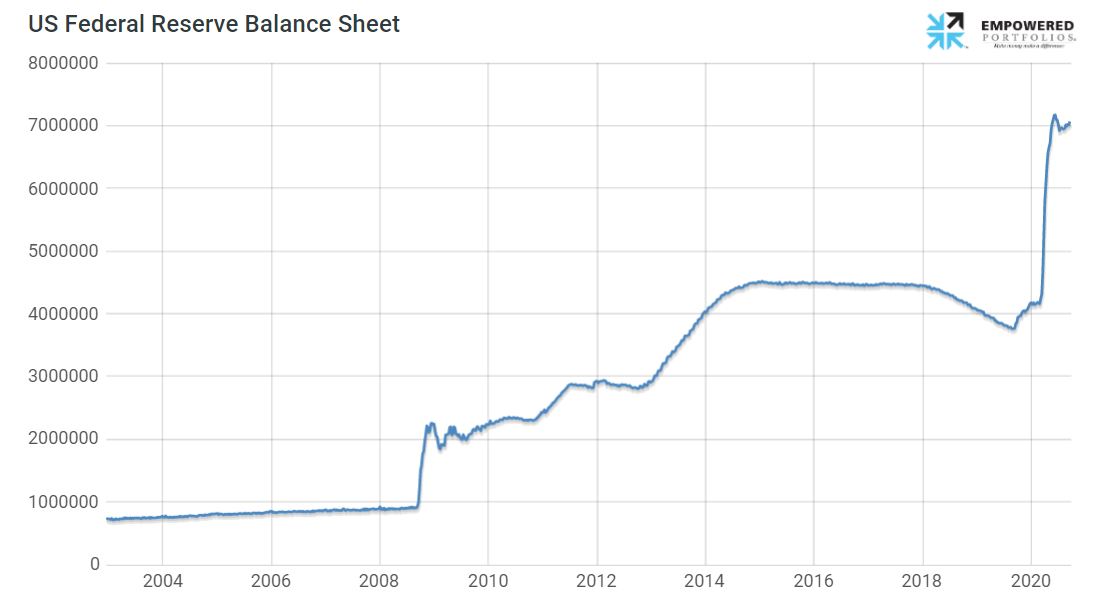

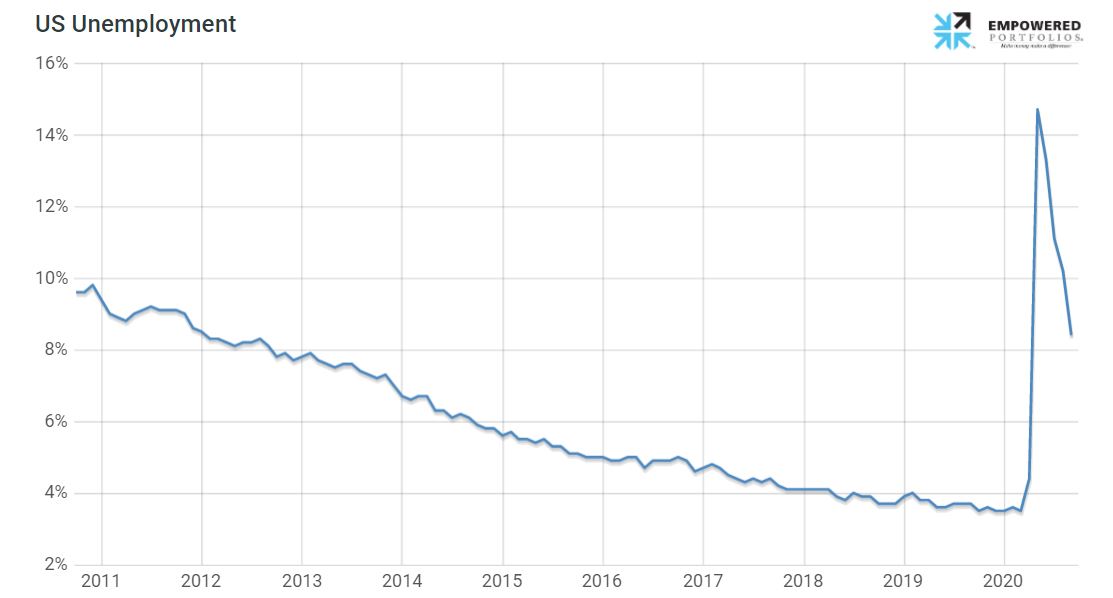

In the spirit of the pictured puppies anxious to exponentially grow, we understand that sleepless nights, broken stuff, and a stain or two, are on the way. We are plenty concerned over the coronavirus and its horrible economic and human toll. In the current quarter, real GDP is likely to drop at about a 30% annual rate, rivaling declines last seen during the late-1945 wind-down from World War II as well as the Great Depression. We also expect an unemployment rate that flirts with 20%, compared to highs of 10% in the aftermath of the Great Recession in 2009.

At the same time, as wealth advisors, Glenwood Financial Partners must look at RISK and REWARDS. None of us can afford to be frozen by fear, but reason and discipline are always in play as we move ahead. Vast opportunities will emerge from the crisis of 2020, and we know the bridge forward will not lead to the past.

Please consider us welcoming resources for any question or discussion in plain language. We want to think better, do better, and serve better.

Email us or call at (919) 268-4100. Hang in there!