Investors should always put an amount of safe money to the side for living, emergencies, and peace of mind.

Laws are like sausages; it is better not to see them being made.

Thankfully, if you choose to participate in markets outside of nearly zero-percent-paying bank accounts, several key advantages exist for private investors—especially when it comes to handling volatility:

- You don’t have to chase returns. Professional investors face relentless pressure to justify their positions, often leading to short-term decision-making. You, on the other hand, can stay patient and let compounding do the work.

- Your financial well-being isn’t tied to daily market swings. Fund managers live and die by quarterly performance metrics, while your financial success is built over years and decades—not headlines.

- You control your time horizon. Unlike institutional investors who must answer to clients and committees, you can invest with a perspective far beyond any given monthly, quarterly, or even annual account statement, each of which reflects just a snapshot in time.

By embracing these advantages, you position yourself to weather market storms with confidence, rather than reacting to short-term noise. The best opportunities often reveal themselves to those who can afford to wait.

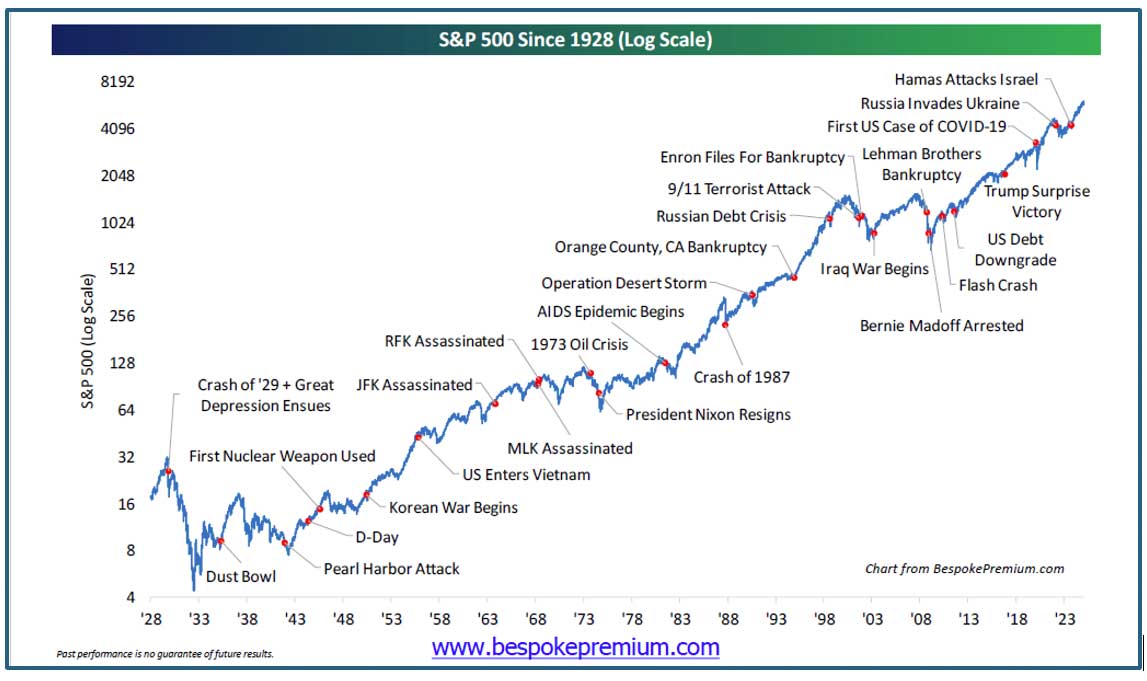

Thankfully, history shows that patient endurance through Democratic and Republican regimes performs overwhelmingly better than letting politics dictate attempts to repeatedly Buy, Sell, and change tactics based on Washington, D.C. Beyond political change, the below historical price chart of the S&P 500 since 1928 reinforces another theme—patient endurance through fearful headlines pays off too. Please notice that through wars, assassinations, bankruptcies, and crashes, the U.S. stock market proves the benefits of patience.

Never bet on the end of the world, because it only happens once.

Of course, every family has unique goals, risk tolerances, and circumstances. That’s why Glenwood Financial Partners promotes a culture of customized advice versus often overly standardized methods. We welcome with open-arms, all inquiries to apply or reapply a framework like the below:

- Together let’s discover where you stand in terms of financials and mindset

- Together let’s make a plan of confidence with flexibility and adjustments in mind

- Together let’s implement the plan with the level of communication you desire

- Together let’s monitor and review how things are going at a reasonable pace

BACK TO MARKETS: In hindsight, we can say that the current bull market of optimism, confidence, and upward index returns started in October 2022, following stocks’ negative response to uncertainties and realities of the COVID-19 pandemic, rapid inflation increases, rising interest rates, and a plethora of other financial and economic headwinds. Nearly 30 months have passed since the S&P 500 started rallying off its October 2022 low point. In that time, we can confidently say the “wall of worry” has been alive and well with no shortage of negative realities to face and overcome—BUT, to be fair, the success of markets has been somewhat concentrated in scope and participation.

Consider that for all of 2023, most of 2024, and now revived in 2025, it seems like every economic and market-based conversation revolves around inflation. And for good reason—when inflation soars U.S. households feel the sting of higher prices across a wide array of goods and services. To make matters more unpleasant for some, interest rates increases raise the costs of borrowing and negatively impact the very important residential housing market.

Recall the bank failures in March 2023? Many investors worried that the financial system would repeat a 2008 style Great Financial Crisis. A handful of key regional banks did fail, and many predictions around that time centered around which ‘shoe would drop’ next. Raleigh’s own First Citizens Bank made the headlines as it acquired the deposits and loans of Silicon Valley Bank after its collapse, which was the second-largest bank failure in U.S. history.

As of March 6, 2025, it has been 45 days since President Donald Trump’s second term officially began on January 20, 2025. The S&P 500’s performance in the first 100 days of a U.S. presidential term varies widely based on economic conditions, market sentiment, and policy expectations. In Trump 1.0, optimism about tax cuts and deregulation provided a backdrop for a positive 5.3% S&P 500 return in those first 100 days of 2017. Not even half-way there by number of days this Trump 2.0-2025, the S&P 500 is essentially flat in performance year-to-date; however, let’s keep in mind that optimism over an extension of tax cuts, less regulation, and other capital-friendly policies helped to drive a pull-forward of S&P 500 returns toward the end of 2024.

Did you endure the State of the Union Address this week? Depending on your point of view there are, like always, a litany of “worries” and “wins” to take away from the speech and the surrounding atmosphere. But rather than get too caught up on what history often proves as “noisy” beginnings of a Presidential Cycle, we prefer to concentrate on the investing advantages afforded to private investors, remain confident in U.S. financial markets’ leadership of resilience and innovation, and provide wealth management advice based on each family’s unique circumstances and investments.

You’ve got to be in it to win it!

It’s fair to say there are a lot of reasons to remain patient with what seems to many investors as a chaotic start to 2025. Perhaps, just perhaps, markets are simply enduring digestion or indigestion that history proves is normal. Optimism surrounds ideas for deregulation and the full extension of tax cuts to boost economic activity and profits. In this context, a more optimistic outlook may be justified. Of course, the challenge is that high and rising expectations for the cyclical upturn raises the bar for upside surprises. The S&P 500 is trading at arguably high valuations today, based on 2025 earnings expectations. We note that the stock prices of companies dominating the S&P 500 index have already risen in anticipation of 2025 and 2026 revenues and profits.

Still, we are optimistic that 2025 financial markets will witness broader upside participation beyond the very powerful themes of extremely large and popular technology companies. We believe private investors have an opportunity to get ahead of stressed-out professional money managers with patient investment weightings in potentially compelling small and mid-sized companies that support popular investing themes while benefitting from lower interest rates and an America First agenda.

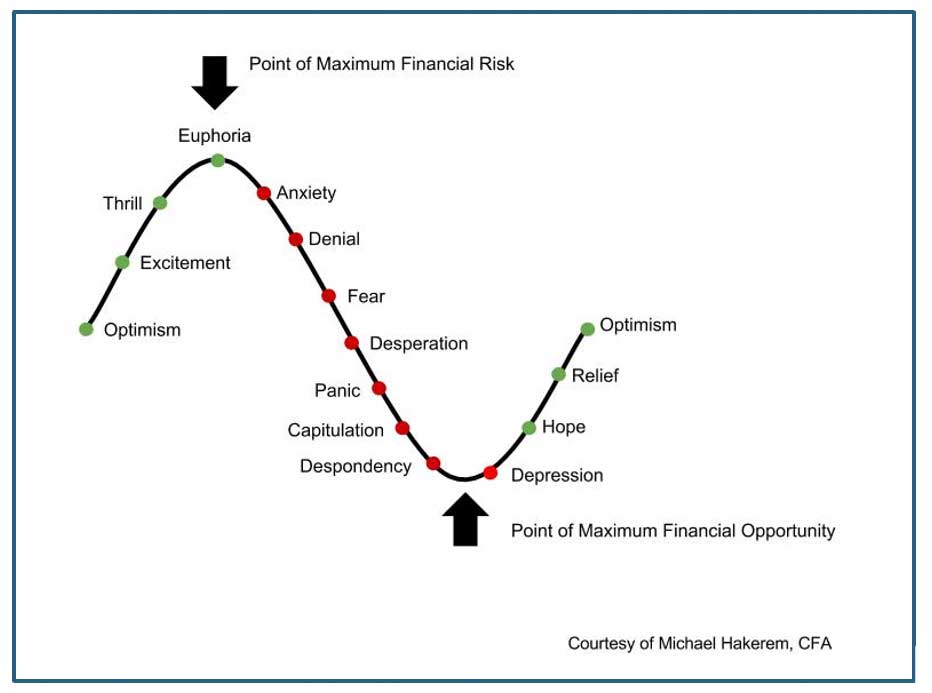

The visual below is very important to understand, and the 94-year-old Warren Buffet captures the essence perfectly with his famous quote,

“Be fearful when others are greedy, and be greedy when others are fearful.”

As we enter the early months of 2025, financial markets are flooded with alarmist headlines about chaos, turmoil, runaway inflation, recession, the threat of global conflict, trade tensions, market volatility, global bond market sell-offs, and diplomatic frictions between sovereign nations.

Fear Does Sell

Fear sells, but there is a reasonably good opportunity for the excitement of a “Golden Age” of U.S. economic and corporate growth to surprise to the upside. Relative to global competitors, ample arguments exist for the U.S. to be the best place to do business—economic growth is stronger, Artificial Intelligence ‘hyper-scalers’ and major technology players have delivered a rapid pace of earnings growth that should broaden out to other companies and sectors in 2025, and the labor market and U.S. consumer are on solid foundations compared to most places in the world. Just because the bar is high, does not mean the U.S. economy cannot continue to clear it.

Beyond the natural advantages afforded to private investors, we believe valuable opportunities come from diversification, personalized portfolio construction, and proactive investment selection based on perceived value—not headlines.

Glenwood’s approach prioritizes a Reward-to-Risk balance that’s aligned with a client’s unique circumstances and long-term investments. Instead of trying to outguess short-term markets, we focus on goals-based wealth management that prioritizes:

- Periodic cash flow needs

- Gifting appreciated stocks to loved ones or charities

- Tax optimization

- Managing risks most relevant to your life

And remember for those that compare their results to the highly concentrated S&P 500: the often-cited index doesn’t need to sleep at night, and it has no children or grandchildren, pays no bills, attends no house of worship, and supports no important causes. You do—and your portfolio should reflect that.

For 2025 and beyond, rather than settling for one-size-fits-all solutions, proactive strategies let you customize your approach to invest in a diversified portfolio of investments with strong fundamentals while capturing offsetting losses where beneficial without being out of the market when the good times come (often out of unexpected places and times). Many investors prefer to maneuver around long-held stocks that are gifted from loved ones, accumulated over time, or acquired due to career choices. A proactive approach potentially gives more freedom to avoid skewed and concentrated risks like that of the S&P 500, which currently has over 30% of its assets in just six stocks.

At Glenwood, we plan to push forward with patience and resist fear.

HERE is one popular example that benefits Glenwood’s style of proactive investment management. By now you’ve likely heard of the November 2022 ChatGPT Release: Artificial Intelligence (AI) has been the dominant market narrative for nearly two years, driving much of the stock market’s gains during this period.

Five Ways Client Portfolios Are Positioned to Participate in AI Themes

While the entire technology sector has benefited from AI enthusiasm, investors should consider multiple approaches to capture this trend, from broad market exposure to targeted investments. We’ve taken a strategic approach to position portfolios based on each Glenwood client’s unique circumstances, and please keep in mind that this list of examples is by no means exhaustive.

- Broad Technology ETFs: For investors seeking lower-risk exposure to the AI trend, broad technology ETFs offer diversified participation in the sector’s growth. These funds provide exposure to both AI leaders and companies adapting AI into their operations, while limiting single-stock risk. We select ETFs with significant holdings in AI-focused companies, some have added income and/or hedging features, and all have reasonable expense ratios relative to alternative exposures of this nature.

- Magnificent Seven Stocks: The Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) represent the forefront of AI innovation and implementation. These companies combine massive R&D budgets, vast data resources, and strong AI talent pools, making them well-positioned to benefit from AI advancement.

- Semiconductor Leaders: The unprecedented demand for AI chips has created a sustained growth opportunity in the semiconductor space. We’re focused on companies with proven AI chip capabilities, those developing next-generation solutions and the leading chip foundries. Another avenue to explore is the developers of custom silicon solutions for hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud- chips are designed specifically to meet the unique demands of hyperscaler workloads, such as artificial intelligence (AI), machine learning (ML), big data analytics, and cloud storage.

- Data Center Infrastructure: Data center REITs and infrastructure providers offer a more stable way to invest in AI growth. These companies generate steady cash flows through long-term contracts while benefiting from the secular growth in AI computing demands. We focus on companies with strategic locations and strong relationships with major tech players.

- Power and Energy Solutions: The enormous energy demands of AI infrastructure are creating compelling investment opportunities across the power generation and utilities sector. Nuclear power utilities stand out as particularly attractive investments, given their ability to provide the consistent, high-volume power output required for AI operations. Companies operating existing nuclear fleets and developing next-generation reactors are well-positioned to benefit from the surge in data center power demands. Major utility companies with significant nuclear assets in their generation portfolio deserve special attention, as they combine stable dividend yields with growth potential tied to AI infrastructure expansion. We are also focused, where risk-suitable, on longer-term innovation in nuclear.

Natural gas is another leading solution for powering AI infrastructure, driven by its reliability, abundance, and growing political support. The current presidential administration’s push for expanding natural gas infrastructure aligns perfectly with the industry’s growing power needs. This policy tailwind, combined with natural gas’s ability to rapidly scale power generation, makes companies throughout the natural gas value chain attractive investment opportunities – from producers and pipeline operators to utilities with significant natural gas generation capacity. We’re focused on long-held leaders here but certainly research a growing number of opportunities for consideration.

The projected $300 billion in AI infrastructure spending by major tech companies this year alone rivals government stimulus packages in scale, creating powerful economic ripple effects across multiple sectors. If plans become reality, then this massive private investment should accelerate job creation, boost demand for raw materials, and grow entirely new supporting industries.

The AI boom has become self-reinforcing as companies across all sectors are forced to invest in AI capabilities to remain competitive. Early adopters are already seeing productivity gains, compelling their competitors to match or exceed these investments. This competitive dynamic ensures sustained capital flows into AI infrastructure, regardless of broader market conditions. Meta Platforms announced plans to significantly increase its capital expenditures in 2025, allocating between $60 billion and $65 billion, primarily to advance its artificial intelligence (AI) initiatives. This investment surpasses previous analysts’ expectations of approximately $51.4 billion.

All this AI talk is not without controversy, uncertainty, and flat-out worry. We appreciate wide-ranging risk factors that impact not only client portfolios, but also society at-large. Still, we cannot help but be optimistically influenced by an impactful first-hand discussion we had with Peter Diamandis at a 2012 book signing in Chicago. Each of Peter’s books reflect a passion for exponential technologies with an eye toward the improvement of lives globally.

Click here for a list of Peter Diamandis’ major books:

- Abundance: The Future Is Better Than You Think (2012)

Co-authored with Steven Kotler, focusing on how technology can solve global challenges. - Bold: How to Go Big, Create Wealth and Impact the World (2015)

A guide for entrepreneurs on using exponential technologies to create transformative businesses. - The Future Is Faster Than You Think: How Converging Technologies Are Transforming Business, Industries, and Our Lives (2020)

Explores how converging technologies are accelerating changes across industries. - Life Force: How New Breakthroughs in Precision Medicine Can Transform the Quality of Your Life & Those You Love (2022)

Co-authored with Tony Robbins and Robert Hariri, covering advances in health and longevity.

Advisory services offered through Kingswood Wealth Advisors, LLC an SEC Registered Investment Advisor, LLC. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. This content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

Information in this message is for the intended recipient[s] only. Please visit our website http://glenwoodfp.com for important disclosures.

CONFIDENTIALITYNOTICE: The content of this message and any files transmitted with it is a confidential and proprietary business communication, which is solely for the use of the intended recipient(s). Any use, distribution, duplication or disclosure by any other person or entity is strictly prohibited. If you are not an intended recipient or this has been received in error, please notify the sender and immediately delete all copies of this communication. Please do not send orders for securities via email, as they cannot be processed.