The Wolves of Wall Street are in the news, blowing volatility into our ears and onto our doorsteps!

So, this is a good time to talk about risk management. By managing risk, you create strategies that help your portfolio weather drops in financial markets. No matter the day, the month, or the year, the concern for your hard-earned assets is at the forefront of Glenwood’s attention to risk management.

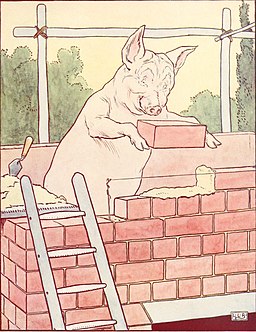

The story of The Three Little Pigs makes the point. The ever-present risk of wind-blown destruction was managed by the pig who built his home brick by brick. Sure, it took more care, time, and discipline to build with bricks in a time of calm, no wolf in sight. And, yes, he had less time to enjoy the trough. But the whole point was asset preservation. The third pig built his house to last.

Similar to building a house to last, client accounts require a full-time stewardship of entrusted assets. A true commitment to risk management requires continuous care from day one.

As for the other little pigs, a purely reactive strategy of calling a brick mason to a house of sticks with a huffing wolf already at the door might have helped some, with luck. But you couldn’t call such a reactive strategy a commitment to risk management.

You must manage risk the moment you begin to invest. And you must do so with a strategy and plan that reflect your unique needs. In short, you should build the bricks of your portfolios to last.

And Glenwood is helping you do this every step of the way. Feel free to contact us if you’d like to talk through your risk strategies. We’re ready to help!