Happy New Year, 2019!

Fifty years ago this September, Hanna-Barbera Productions brought life to a cartoon featuring a Great Dane named Scooby-Doo. The charismatic, Scooby Snack loving pup traveled around with four teenage companions in a green van known as “The Mystery Machine.” The team’s objective each episode was to investigate and solve a seemingly unusual and far-fetched mystery. Fifty years later, we have in common today the perseverance, the passion, and the discipline to look past emotions and dig for facts as we look to unmask market mysteries.

Economic data and earnings reports are supposed to reveal the mystery behind “the fundamentals” of an economy. Each new year brings numerous stories and themes that are often the key drivers of investment activity, and sometimes scary headlines and other threats lurk in the shadows. As we enter the investing year of 2019, financial markets are investigating competing narratives and uncertainties. Rest assured that Glenwood parses through the data you read about.

Will the U.S. economy enter recession? Is inflation a threat? Can global central bankers successfully navigate full employment, interest-rate changes, and balance sheet adjustments? Some argue that riskier assets from stocks to credit took a price-hit in late 2018 in anticipation of the above; however, a puzzle remains as to whether 2018’s pullback in markets will prove prescient or overly fretful.

Glenwood has a process and discipline to constantly evaluate the clues of the markets without emotional guesswork. Our scenario stress testing work greatly supports an ability to assess opportunities and risks that are most important to clients’ unique circumstances and investment holdings.

With respect to positioning financial plans, retirement lifestyles, budgeting, and portfolios for the next 3-5 years, we see an eventual unmasking of current mysteries to reveal just more false ghosts designed to keep us away from opportunities.

THREE KEY TAKEAWAYS

- Recession risks, while meaningful in the short-term, should not shake most

investors away from significantly positive and long-lasting investing trends - The Future is Brighter Than We May Think

- Rhymes with the period from 1969 to 1979

RECESSION. So, despite scary headlines about yield-curves, the number of days since the last recession, and other economic “evidence,” we see no signs that the economy is in a recession or about to enter one. In fact, even if the risks to the economic outlook are weighted to the downside and market participants fear a downturn later this year or in 2020, our current outlook puts a 75% or better probability that our next recession will be shallow and short in length.

THE FUTURE. Fear is created out of every little noise. Anger and despair are enhanced with anchored views. We see a different global story and believe an edge of understanding is available to those willing to look. Over the next 3-5 years, we believe exciting narratives will evolve in a way that brings today’s disruption into another cycle of emerging innovation and the best time yet to be a human living on Earth.

Did you know?!

- Over 10% of the world’s energy now comes from renewable sources–Up from

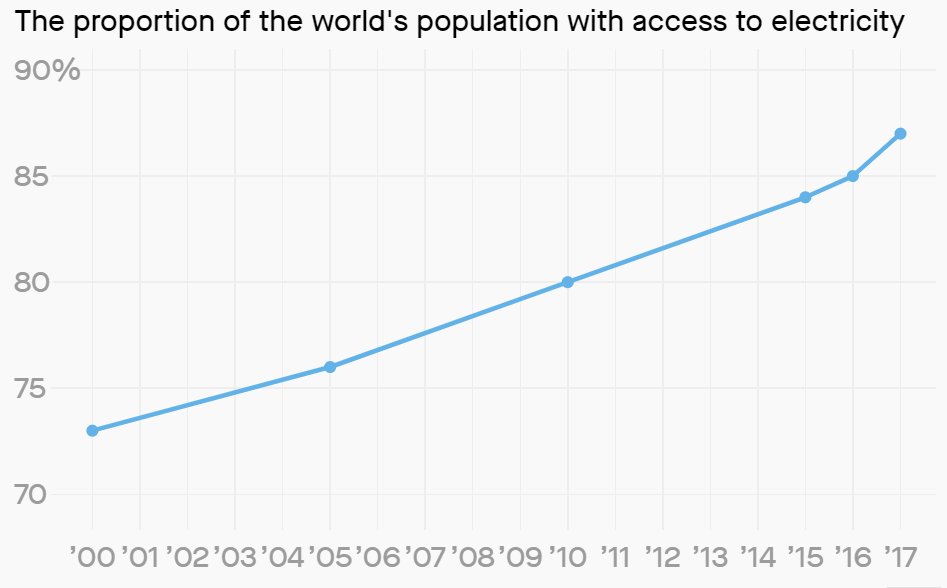

7.5% in 2000 - 87% of people around the world had access to electricity in 2017–essential to

health, education, and general satisfaction - Global infant mortality and maternal mortality continue to plummet

- Teen pregnancy rates are falling worldwide

- Global tuberculosis and malaria rates continue to fall

- Global women’s share of government seats passed 23% in 2016, and rose to

nearly 24% in 2017–At least 121 women will serve in U.S. Congress

The above bullet-points highlight significantly positive trends that matter as a foundation for global growth of healthy consumers, productive workers, and overall political stability. When is the last time you heard the evening news pay majority attention to hope and prosperity? Unfortunately, statistical research proves that negative news sells.

Sure, a lot went wrong in 2018. It is so easy to lose sight of global improvements in the midst of a constant streaming/tweeting/facebooking of bad news. It may be hard to believe; however, despite failed leaders, scandals, and near-term standoffs, 2019 and each year thereafter have the potential to create a very attractive environment for income and capital appreciation opportunities.

Source: International Energy Agency

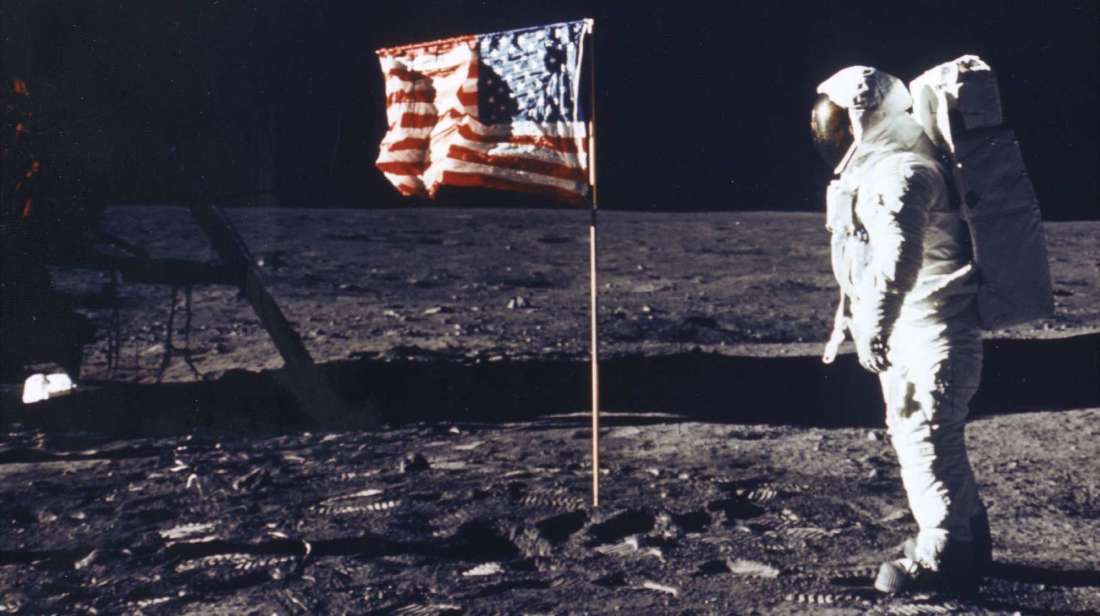

RHYMES. While 1969 brought us the entertainment of What’s New Scooby-Doo?, The ’70s were tumultuous & hard. The decade was dominated by cultural, social, economic, and political strife that manifested in unusual events. Kent State shootings, Pentagon papers and Vietnam War, Watergate and Nixon, Roe v. Wade, domestic & international terrorism, hundreds of thousands killed in global natural disasters, serial killers and The Jonestown Massacre all occurred. The nation experienced an oil crisis and Arab oil embargo, disengagement from the gold standard, double-digit inflation, and a stock market crash with a bear market between January 1973 and December 1974.

Disruption and anger proved fertile ground for seeds of change. Women’s and conservation movements gained traction. Intel’s first microprocessor, Apple, and Microsoft were first conceived. The first email was sent on the ARPANET. By decade’s end, inflation and dividends had contributed to the S&P 500’s 75%+ total-return. In fact, seven of the ten years in the decade experienced positive returns. History may not repeat but it’s good to think over a rhyme or two.

There should be no mystery about our desire to fully discuss the outlook for 2019 and your unique interests and needs.

Happy New Year and please click the below for an interesting walk-through 1969.