The contentious U.S. presidential election is over. Given the roughly even split among voters, it’s understandable that many of our readers are disappointed while others are elated. When it comes to investing, however, emotions often are a hinderance to patient and disciplined investing. History makes it clear that the stock market has no political preference in terms of the long-term time horizons for which our clients plan (think retirement, inheritance, and legacy goals).

Our message to investors in both the immediacy of election outcomes and for the long-term is clear: stay focused on your objectives and remember what it takes to achieve them. An asset allocation that’s aligned with your unique long-term goals, income needs, risk tolerance(s), and one that’s driven by economic fundamentals and corporate earnings seems to be a much better focus than short-term political outcomes and the surrounding emotions and often ill-gotten worries.

We like to say that “fear sells newsletters and courage builds wealth: patience takes courage!”

This is not to say that election results do not matter. They do, as the president influences and sometimes establishes economic policies. Remember, too, that economic cycles do not fit neatly into four-year boxes depending on what party is in power.

History reminds us to keep our cool. Since the inception of a version of the S&P 500 in the 1920’s, there have been 24 U.S. presidential elections. In 20 of them, the S&P 500 Index registered positive total returns. In the four instances when the stock market fell, the U.S. economy was in the Great Depression, the early days of World War II, the 2000 tech bubble, and the 2008 Global Financial Crisis. Today, we have 4% unemployment, roughly 2.5% inflation, 2+% GDP growth, and solid corporate earnings growth. This is the data that matters over the long run.

As we navigate the post-election landscape, now is the perfect opportunity to revisit and strengthen your unique portfolio. Designing a retirement portfolio that holds up in any market environment can be challenging. So, today and every day, Glenwood Financial Partners can offer guidance that relies on investment frameworks that clients often comment are simple, effective, and easy to understand.

As long-time advisors for real families, our mission is not to “convince,” but rather to educate and lead the conversation as financial stewards with a focus on simplicity as a competitive advantage. To pique your interest, here are a few of the most common topics of our conversations:

- Patience, Discipline, Process, and Customization

- Focus on What You Can Better Control

- The Right Asset, in The Right Portfolio, at the Right Time

- Defining Your Sleep-at-Night Factor

- Reward-to-Risk as told through the story of a lion, a gazelle, and raging rivers full of big crocs

- Asset Allocation as told through an Ark (think Noah), a Speedboat, and a Tight Bathing Suit

Nevertheless, in our 30+ years as an investment manager, there has always been investor sentiment that if candidate “X” wins the election, it will be bad for the stock market. But a look at past election year returns—as well as longer-term returns for U.S. stocks—demonstrates that such an outcome has never materialized. In the cases where we have seen post-election downturns, it has been tied to broader economic factors—not the election or re-election of a president.

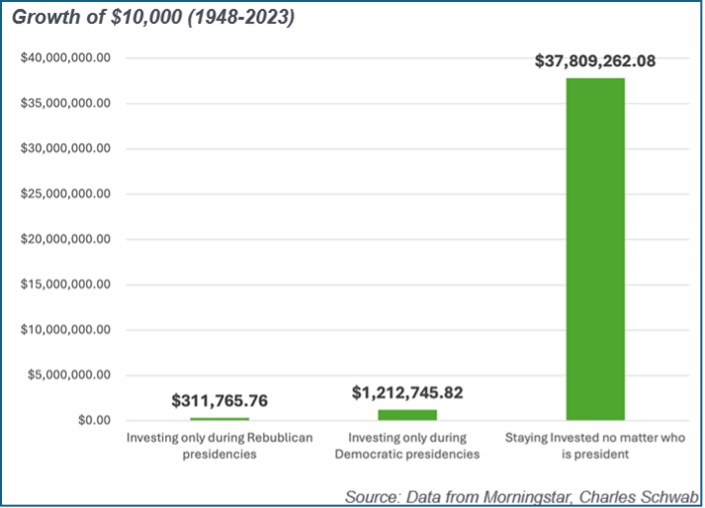

The chart below drives this point home. If a person invested money in the stock market only when their preferred political party was in the White House, it would have meant severely reducing total returns over time. This is true of both Democrats and Republicans. Investing for the long-term—regardless of who was president—clearly delivered the best result.

If investors are looking for somewhere to divert their attention in a noisy political climate, look no further than U.S. corporate earnings. The news cycle has essentially buried any mention of the stock market’s most critical driver, in our view. There are plenty of reasons to be optimistic.

Through November 1, we have seen Q3 results from 350 S&P 500 index members, or 70% of the index’s total membership. Total earnings for these 350 companies are +8.8% higher than the same period last year on +5.7% higher revenues. 74.9% of these reporting companies beat their earnings per share (EPS) estimates and 60.6% beat revenue estimates. These are solid results.

If we look at earnings and revenue growth rates for these 350 companies compared to previous periods, we find that both are solidly above average.

Finally, if we combined current results with estimates for the 150 companies yet to report, we find that total earnings growth for the S&P 500 index could be nearly 7% year-over-year with over +5% higher revenues. Again, these are nicely positive results, and ones that investors should focus on more than the election. And some would say that the talk of higher tax rates on corporate taxes and capital gains seems to have subsided since election day.

Bottom Line for Investors

Over time, the stock market responds more to long-term earnings and economic growth trends than to changes in political leadership. We know that the initial emotional gravity of an election such as ours can be very real on a personal level. But we believe that this mindset puts far too much emphasis on political figures and policies, and far too little emphasis on the real engines of the U.S. economy – corporate earnings, small business growth, investment, the consumer, and innovation.

Politicians come and go, but the desire to grow, innovate, and pursue profit remains a constant.

Focusing on these enduring economic drivers, rather than political shifts, can help you take a more grounded approach to investing. To support this perspective, we continuously offer our insights and simple investing frameworks to all who inquire.

Cheers to Patience!

Michael Hakerem

Chief Investment Officer