In advance of President Trump’s 9PM speech to Congress on Tuesday night, February 28, we hope for his delivery of details and clarity, but, in any event, we look to the future service of our clients with emphasis upon the advantage of simplicity, the danger of emotional decision-making, and the disciplined evaluation of markets and securities.

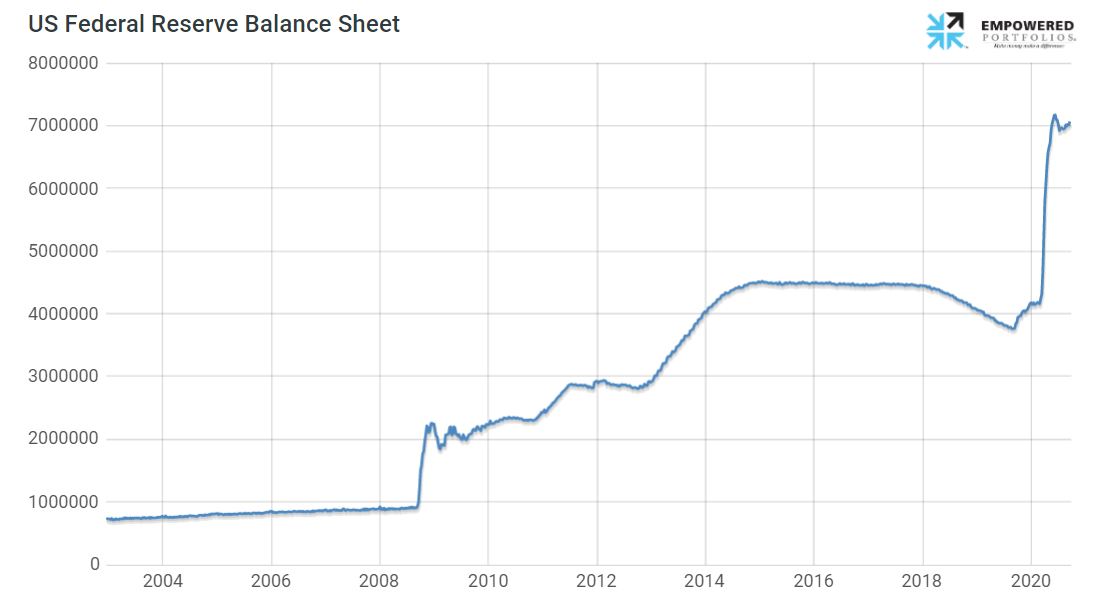

Looking back, in November we were invited to speak at a money manager panel just after the 2016 presidential election. As expected, the moderator asked for our initial take on president-elect Trump. First response? We first compared the pre-election financial scene as a calm and glassy backyard swimming pool full of the liquidity provided by the world’s central bankers. In this scene, the water (liquidity) had risen, the rafts floated higher (think stocks and bonds), politicians were sipping lemonades, and investors were riding high.

Then, Splash!

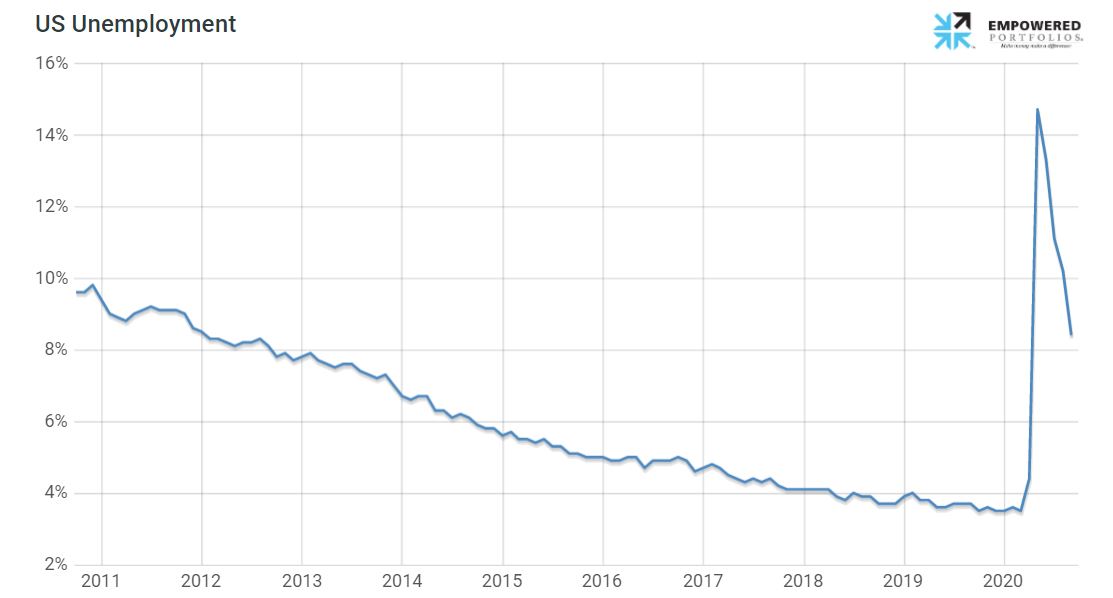

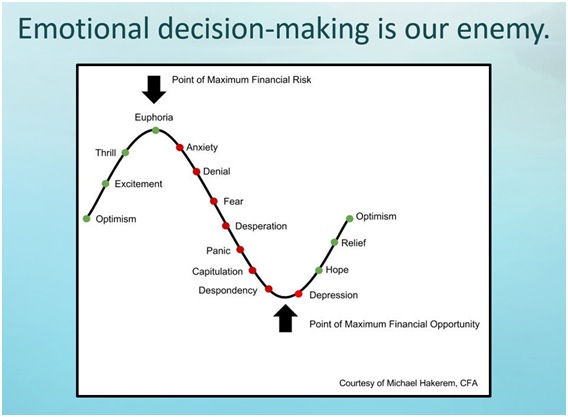

Donald Trump did the previously unthinkable and got elected. This unexpected Trump cannonball rocked the calm, created waves of uncertainty, and politicians and investors were tossed about without warning. The collision of Euphoria and Despondency generated massive waves with some riding the peaks and others flipped into oblivion. Panicking investors needed reassurance, flotation devices. Solution? Rescue them with the value of proactive thinking, the flexibility to pivot from too rigid models, and a steadfast focus on their unique circumstances.

Today, too many commentators naively claim there is a lack of market volatility—Look underneath the headline figures and you will see plenty of dispersion among global stocks, bonds, commodities (like oil), and even the commentaries themselves. In other words, there is a deep pool of uncertainty, emotion, and volatility!

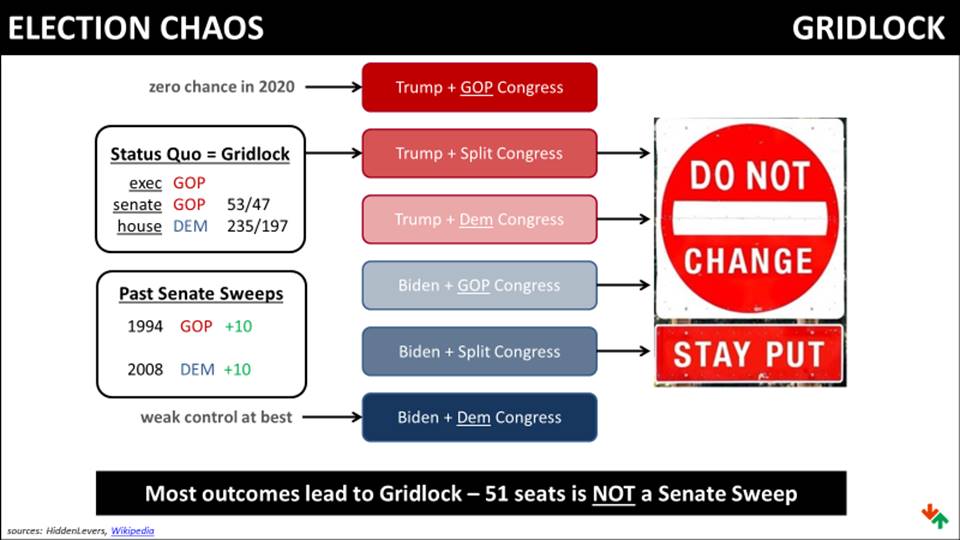

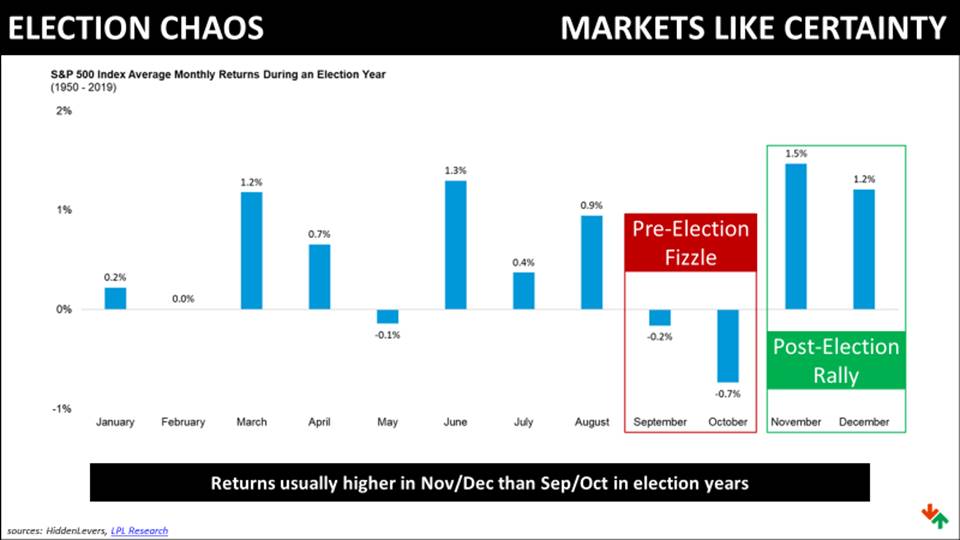

We expect the glaring political divide to be on full display tonight, tomorrow, next week, next month…We can all feel the spring load of dramatic headlines, uncomfortable news conferences, and the consequences for global financial markets. However, predictability is…unpredictable. Instead, we choose to promote more reliable approaches to financial markets in pursuit of our clients’ planning goals. Below are two Glenwood Financial Partners’ slides highlighted in recent speeches and meetings.

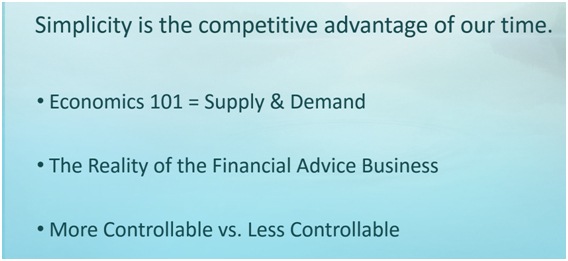

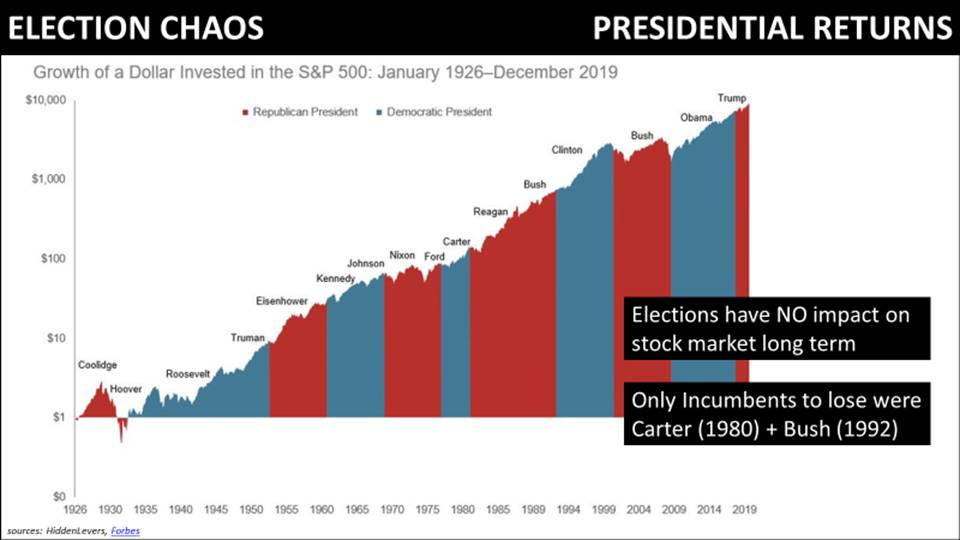

We believe that simplicity truly is the competitive advantage of our times. Accordingly, we believe that investors and their advisors should embrace the three points listed. At the end of the day, supply and demand determine prices. The reality is that many financial advisors try to scare investors into thinking complexity is worth a lot of fees and contributes to abnormally high returns—WRONG! We at Glenwood speak in plain language. Finally, the more controllable factors in life include things like spending, saving, and communicating true dreams, hopes, and fears. The much less controllable factors in life include presidential speeches, tweets, and agendas. It is hard to outguess the Federal Reserve’s plans for U.S. interest rates. Furthermore, no human or robot has consistently prognosticated the exact level of any stock index or economic data point.

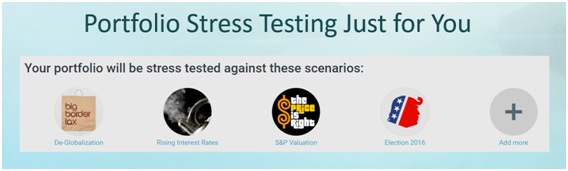

One thing is certain. Emotional decision-making is dangerous. In fact, we have devoted a career to the construction of proprietary tools and techniques to further our capabilities away from human behavioral mistakes. Every client’s portfolio is uniquely constructed and its investment holdings refreshed and monitored each new trading day. For example, Glenwood has engaged best-in-class strategic partners that allow us to stress portfolios for all-kinds of scenarios and to unemotionally understand the potential reward and risks specific to our unique client. This analysis has the capability to measure millions of relationships between the economy and investments–It’s awesome!

Prime Time

Like the rest of the world, we anxiously await the details that we hope President Trump will provide in tonight’s address to a joint session of Congress. Hopefully, more clarity will emerge. Fears of a major pullback if President Trump does not outline a ‘phenomenal’ tax program may be overdone and one thing is for sure: We at Glenwood will rely on a disciplined evaluation of markets and individual securities going forward.

Today and tomorrow, our goal is to help you live your best life. Please consider us welcoming resources for any question or discussion in plain language. We believe in a forthright and caring approach, and we are always delighted to talk things over. We want to think better, do better, and serve better.

Email us or call at (919) 268-4101. Enjoy today!

The information set forth herein is for informational purposes only and should not be used as the sole basis for an investment decision. While we have made every attempt to ensure that the information contained in this Site has been obtained from reliable sources, we are not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this Site is provided “as is,” with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied.