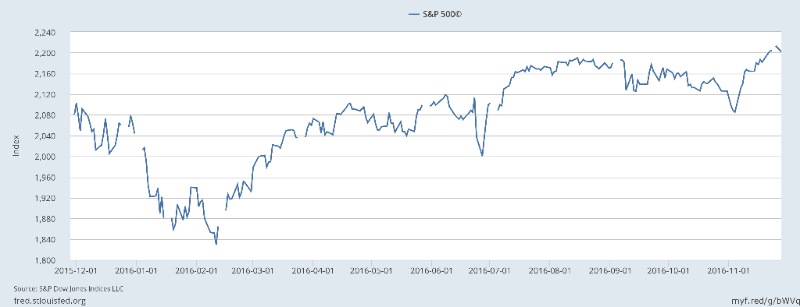

The S&P 500 is a widely-used gauge of the large cap U.S. equities market. The below price-only (no dividends) index includes 500 leading companies in leading industries of the U.S. economy, which are publicly held on either the NYSE or NASDAQ, and covers 75% of U.S. equity market capitalization. The price has moved upward by over 5% since November 4th.

New Highs in Stocks & Selloff in Bonds

We saw the third straight week of gains for stocks in America as investors react to the “surprise” election as “more friendly” for the US economy and US companies. Promises of a big government spending program aimed at building infrastructure (e.g. airports, roads and bridges) have investors excited about companies that are geared to those types of projects. Hopes of lower taxes for businesses as well as fewer laws that regulate their activities are also providing fuel for stock prices.

These positives have outweighed the possible negative effects on the economy of reduced immigration and trade (at least, per the moves in the stock market). Glenwood Financial Partners is always cautious to note two critical features of surprise events: 1) initial reactions do not always last, and 2) extrapolation is not a dependable forecasting tool.

Will Higher Interest Rates be Targeted?

The 10-year treasury note is a widely-used gauge of the fixed-income market. This debt obligation issued by the United States government matures in 10 years and pays interest at a fixed rate once every six months and pays the face value to the holder at maturity. The below graph illustrates the upward move in yield to nearly 2.4%. There is an inverse relationship with bond yields and prices. So, a 10-year note purchased on November 4th (when stocks were suffering) has moved downward in price by roughly 4%.

The same drivers of upward stock prices are arguably pressuring bond prices as interest rates and inflation expectations rise. The collective markets now signal a 100% probability that the U.S. Federal Reserve will raise its Federal Funds interest rate target at December’s meeting. Higher rates and inflation have implications for mortgage rates, auto sales, U.S. debt, and your future purchasing power.

Of course, we know that a surprise “non-event” could be in the offing with respect to interest rates. The Federal Reserve may take a wait-and-see approach to the president-elect’s 2017 agenda. Federal Reserve Chair, Dr. Janet Yellen will hold a press conference and answer questions from the financial press at approximately 2:15 p.m. on December 14th—Financial Markets may get even more volatile.

Will Diversification Work in 2017?

US-centric stocks have done relatively well as compared to alternatives. To some, it appears owning anything else but U.S. stocks is foolhardy. Glenwood Financial Partners believes diversification across multiple global markets and unique asset classes still makes a lot of sense.

Our portfolio management disciplines still favor client-centric decision-making with an emphasis on risk management, low relative total expenses, and the preservation of principal from the potential erosive effects of taxes and inflation.

We must humbly resist an attempt to outguess the Federal Reserve, Donald Trump, or the exact course of financial markets. Instead, we use less-emotional tools and analysis to evaluate every current holding and potential holding in the context of each client’s unique circumstances, fears, and dreams.

We thank the Federal Reserve Bank of St. Louis for the incredible job they have done providing data and graphics to the public. Here is the credit and legal notice related to all FRED charts: FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved. All FRED® Graphs appear courtesy of Federal Reserve Bank of St. Louis. https://research.stlouisfed.org/fred2/

The information set forth herein is for informational purposes only and should not be used as the sole basis for an investment decision. This material contained herein should not be considered a recommendation to buy or sell securities in the United States or in any other jurisdiction. While we have made every attempt to ensure that the information contained in this Site has been obtained from reliable sources, we are not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this Site is provided “as is,” with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied.